Maharashtra PTRC return filing error

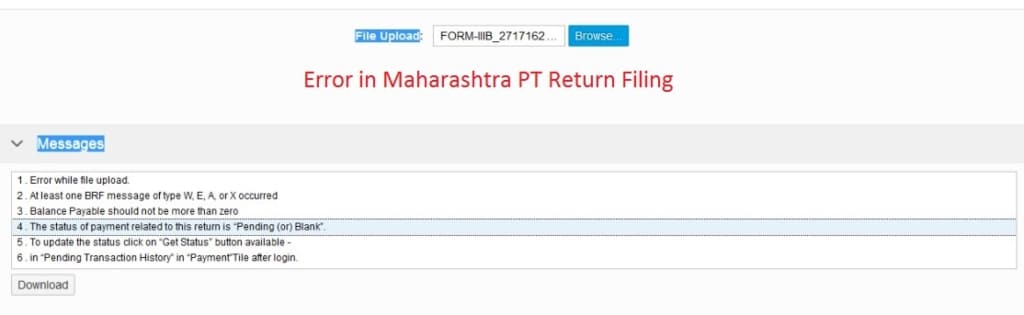

Problem: While filing PTRC return for maharashtra on the mahagst.gov.in website, the following error occurs –

1. Error while file upload.

2. Atleast one BRF message of type W, E, A, or X occurred.

3. Balance payable cannot be more than zero.

Solution –

The portal is attempting to locate the tax paid challan for the same period as the return. Many taxpayers are paying the challan with the period selected for the previous month. For eg. Return period is 01.04.18 to 30.04.18 but the challan is period is 01.03.18 to 31.03.18. In such cases the taxpayer is required to approach his nodal officer and opt for challan correction. Once the challan and return period is the same, system readily accepts the return.

This is also supported by Rule 11 of the PTRC rules and trade circular 48T dated 23.11.18. Both Rule 11 and the trade circular are attached to this blog post for ready reference.

Khanolkar & Associates, Chartered Accountants, from Pune can assist with your various taxation needs including but not limited to PTRC, MVAT assessments, GST filing and Audit, Statutory audit, Internal Audit, etc. Get in touch to know more on how we can streamline your taxation needs with constantly evolving tax laws.

Sir,

I am trying to file PTRC return for the F Y 2021-2022. But Facing following error, please provide solution –

1. Error while submitting return.

2. Posting period 01 2022 for company code MSTD already closed

3. –> Error from check of posting document Posting Document for Billing Document FKKINVBILL

4. –> Reporting invoicing function: Invoicing of Billing Documents

5. Posting period 01 2022 for company code MSTD already closed

6. –> Error from check of posting document Posting Document for Billing Document FKKINVBILL

7. –> Reporting invoicing function: Invoicing of Billing Documents

8. Unable to process invoicing unit for contract account 27461566827

9. *** Documents to be processed in invoicing unit:

10. ***** Source document category-source document number INVBI -2100046535

11. *******

12. Errors occurred when posting invoicing documents for form bundle 92025260

sir my return period is 1/3/2020 to 31/3/2020 and by mistke paid challan period is 1/3/2020 to 31/3/2020. I have face some below error. how can I sort out the below error . please guide me

1 error while file upload

2 brf message of type w,e,a, or x occurred

3 balance payable should not be more than zero

ptrc return

1 error while file upload

2 brf message of type w,e,a, or x occurred

3 balance payable should not be more than zero

hello sir i m ptrc return fillinging doing but this error is coming , and i m doing monthly return filling

f.y. 19-20 annualy return

Hi Sir,

How to correct mistake in ptrc challan, if vat no. wrongly selected of another party ?

Please give us, idea of correction of PTRC challan.

Error while submitting return.|Balance Payable should not be more than zero|The status of payment related to this return is %u201CPending (or) Blank%u201D.|To update the status click on %u201CGet Status%u201D button available -|in %u201CPending Transaction History%u201D in %u201CPayment%u201DTile after login.|

I Upload PT return for the month of October 2019 and the error coming is Upload is in Progress

ptrc return

1 error while file upload

2 brf message of type w,e,a, or x occurred

3 balance payable should not be more than zero

hello sir ptrc no upload file

f.y. 19-20 annualy return

challan date 23-09-2019 please return solution

When am going to filiing pt returns June-2018 return below getting error…….please help and advice about below error

1.Error while file upload.

2.Period key in file and portal are not same. Period in file is 1803|

When am going to filiing pt returns June return below getting error…….please help and advice about below error

1.Error while file upload.

2.Period key in file and portal are not same. Period in file is 1803|

1. Error while file upload.

2. Atleast one BRF message of type W, E, A, or X occurred.

3. Balance payable cannot be more than zero

PTRC RETURN FILING ERROR

error while file upload

2 brf message of type w,e, a, or x occurred

3 balance payable should not be more than zero

4 The status of payment related to this return is ‘pending’ or ‘blank’

5 To update the status click on ‘get status’ button available.

6 In ‘ pending transaction history in “payment” tile after login.

hello sir ptrc no upload file

F.Y 2018-2019

PTRC RETURN FILING ERROR

error while file upload

2 brf message of type w,e, a, or x occurred

3 balance payable should not be more than zero

4 The status of payment related to this return is ‘pending’ or ‘blank’

5 To update the status click on ‘get status’ button available.

6 In ‘ pending transaction history in “payment” tile after login.

hello sir ptrc no upload file

F.Y 2018-2019

Dear Sir,

I am filing PTRC Rtn for the month of Mar19 , Challan Paid & Rtn month shows Apr19 (Both are Same). . Then also i am getting the Error

ptrc return

1 error while file upload

2 brf message of type w,e,a, or x occurred

3 balance payable should not be more than zero

Pls Help me

ptrc return

1 error while file upload

2 brf message of type w,e,a, or x occurred

3 balance payable should not be more than zero

hello sir i m ptrc return fillinging doing but this error is coming , and i m doing annual return filling

f.y. 17-18 annualy return

Challan Period & return period is same.still same error is there.Please help

Hi Shruti,

I am trying to file PT return for Feb 2019. PT period on challan is 01.03.19 to 31.03.19 and & we paid PT dtd on 01.03.19 & i am filing since 1st march 19

but error come as follws

trc return

1 error while file upload

2 brf message of type w,e,a, or x occurred

3 balance payable should not be more than zero

Dear sir

I am trying to file PT return for Apr.18 and also mention there march pt amount and challan but why system automatically taken april challan …. i don’t know

please help me

I am facing below error while filing return

At least one BRF message of type W, E, A, or X occurred

Error while file upload

At least one BRF message of type W, E, A, or X occurred

Credit carried forward cannot be more than Excess Credit available

I’m getting the above following errors.

Please help

Even if the challan period and Return period are the same…Same error occured

i am trying to file the return but uploading is processing this is the comment seen .

PT Return erorr

1.

2. Upload in Process

showing me error

Upload is in progress

Hi,

I think this problem coming because you have not selected correctly the filed “Whether First Return ? (In Case of New Registration )”. If you select no in return, than there should be earlier period returns available on the portal.

Dear Mr. Paresh,

I am trying to file PT return for Apr 2018. PT period on challan and return is same i.e. 01.05.2018 still i am getting same error while return filling.

Can you please help me so i can file our return smoothly.

Hello Mr. Sameer,

The from date and to date on both – return and challan should be the same. The return should get accepted if it is.

hello sir,

while ptrc challan preparing below errer is occurs . pl. give solution.

GRN is not generated due to the following Errors for URN NO. (URN10003858680TR)Invalid IP ( 115.249.59.140 ) for Office ( STD001 )

I Uploaded PT Return for the Period 2019-2020 and the Month of October 2019 and the error coming to my Side is Upload is in Progress

ptrc return

1 error while file upload

2 brf message of type w,e,a, or x occurred

3 balance payable should not be more than zero

hello sir ptrc no upload file

f.y. 17-18 annualy return

challan date 29-03-2018 please return solution

shreepounikar@gmail.com

Even if the challan period and Return period are the same…Same error occured