Master Guide – Maharashtra Amnesty Scheme 2022

Introduction

Government of Maharashtra announced Amnesty scheme in the state budget on 11/03/2022. To give effect to the same the Maharashtra Settlement of Arrears of Tax, Interest, Penalty or Late Fee Act, 2022 was enacted on 28/03/2022. Previously, taxpayers have witnessed 2 such Amnesty schemes – in 2016 and 2019. The present scheme of 2022 is not the same as its predecessors. There are certain obvious differences and some subtle ones which one must interpret to understand the true nature of the act. In this article, an attempt has been made to bring out the different aspects of the scheme while highlighting how the scheme differs from its earlier versions.

General scheme of the Act

Applicability

The benefit of the act can be taken by both registered dealers and unregistered persons. The Act has not restricted its application to only registered persons. Even dealers who have not yet taken registration under any of the acts can opt for the scheme. It is also clarified that even though any dealer may have taken benefit of any of the earlier schemes of 2016 and 2019, they shall be eligible to take benefit of this scheme too. The scheme is also applicable if the appeal is preferred by the department against the dealer.

Types of dues

The scheme can be availed for arrears of Tax, Interest, Penalty and Late fees. These arrears may be recoverable on account of 3 reasons-

i. As a result of any statutory order passed

ii. Admitted in any original or revised return and remaining unpaid wholly or partially.

iii. Determined and recommended to be paid by the auditor in audit report (Form 704)

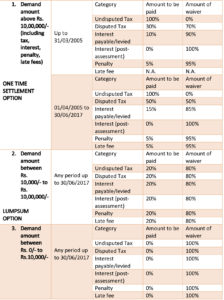

Tax may be ‘Disputed tax’ or ‘Undisputed tax’ and depending on its nature different % of waiver is applicable to each.

Disputed tax –

Undisputed tax –

Acts covered under the scheme

(i) the Central Sales Tax Act, 1956 ;

(ii) the Bombay Sales of Motor Spirit Taxation Act, 1958;

(iii) the Bombay Sales Tax Act, 1959 ;

(iv) the Maharashtra Purchase Tax on Sugarcane Act, 1962 ;

(v) the Maharashtra State Tax on Professions, Trades, Callings and Employments Act, 1975 ;

(vi) the Maharashtra Sales Tax on the Transfer of Right to use any Goods for any Purpose Act, 1985 ;

(vii) the Maharashtra Tax on Entry of Motor Vehicles into Local Areas Act, 1987 ;

(viii) the Maharashtra Tax on Luxuries Act, 1987 ;

(ix) the Maharashtra Sales Tax on the Transfer of Property in Goods involved in the Execution of Works Contract (Re-enacted) Act, 1989 ;

(x) the Maharashtra Tax on the Entry of Goods into Local Areas Act, 2002; and

(xi) the Maharashtra Value Added Tax Act, 2002 ;

and also includes the rules made or notifications issued thereunder ;

Tax period covered

The scheme shall be applicable for any period ending on or before 30th June 2022. This period is further divided into 2 parts –

a. Post 01/04/2005 (regular waiver)

b. Pre 01/04/2005 (higher waiver)

Benefit/Waiver under the scheme

Time limit for making application

For payment of requisite amount: 01-04-2022 to 30-09-2022

For filing application: 01-04-2022 to 14-10-2022

Condition for availing benefit

In order to take benefit the the scheme dealer must unconditionally withdraw the appeal which may be pending before any appellate authority

Other miscellaneous features of the scheme

- No application shall be rejected merely for payment of short amount. Instead proportionate benefit would be given.

- If Amnesty application is rejected for any reason whatsoever, then the appeal withdrawn earlier to be automatically restored.

- Any amount paid before 31-03-2022 except under appeal will not be considered towards requisite amount.

- If applicant does not have sufficient funds to pay requisite amount, then he can opt for instalment scheme wherein 25% amount needs to be paid upfront and balance in 3 equal instalments. Note that any delay in payment of instalments will attract interest at 12% p.a.