How to apply for Lower or Nil TDS deduction certificate for NRIs | Easy Guide with screenshots

a. You are an NRI wanting to sell your property

OR

b. You are a buyer who is in the process of buying a property from an NRI

and there is a lot of conflicting information on the internet. The purpose of this article is to consolidate the entire body of knowledge in one place, backed by relevant statutory provisionsto help one make an informed decision.

This article is structured as follows-

- What are the applicable TDS rates to NRIs

- Documents required for making an application for Lower/Nil TDS deduction certificate

- How to apply for Lower/Nil TDS deduction certificate online

- Steps to be taken after getting Lower/Nil TDS deduction certificate

- Frequently asked questions

- What are the relevant statutory provisions

What are the applicable TDS rates to NRIs

Depending of the sale value of property, the applicable TDS rates can be divided into the following categories:

| Particulars | Less than 50 lakhs | 50 lakhs to 1 crore | More than 1 crore |

| Tax rate | 20.00% | 20.00% | 20.00% |

| Surcharge | 0% | 10% of tax | 15% of tax |

| Tax + Surcharge | 20.00% | 22.00% | 23.00% |

| Education Cess | 4% of above | 4% of above | 4% of above |

| Effective rate | 20.80% | 22.88% | 23.92% |

Documents required for making an application for Lower/Nil TDS deduction certificate

- Copy of Buyer’s TAN

- Computation of Long term/Short term capital gain

- Copy of Form 26AS for past 4 years

- Copy of Indian ITR of past 4 years. If not filed, then affidavit to that effect on Rs. 500 stamp paper.

- Copy of returns filed abroad for past 4 years

- Copy of stamp duty valuation issued by Government Registrar office

- Copy of Seller’s PAN

- Proof of NRI – Foreign passport or Visa In/Out entries or Foreign driving license

- Copy of Index II and registered Purchase deed

- Possession letter

- Copy of draft sale deed duly signed

- Consent letter of buyers/sellers if there are more than 1 buyer or seller and certificate is to be issued in the name of only 1 buyer or for only 1 seller

- Payment schedule from bank in case of loan

- Authority letter on Rs. 500 stamp paper

Note – If seller has taken any advance before applying for certificate then the certificate will be issued only for balance amount as per Income tax department S.O.P. issued vide F.No. Pr. C.C.I.T. (Int. Tax) H/272/2022-23/4106 dated 21/11/2022.

How to apply for Lower/Nil TDS deduction certificate online

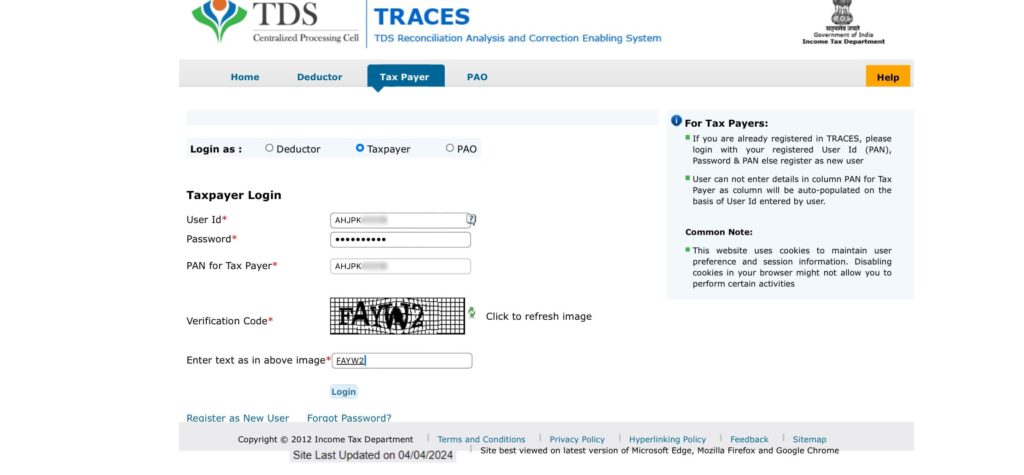

1. Register as a new user at https://www.tdscpc.gov.in/app/tapreg1.xhtml

2. Login using the username and password created.

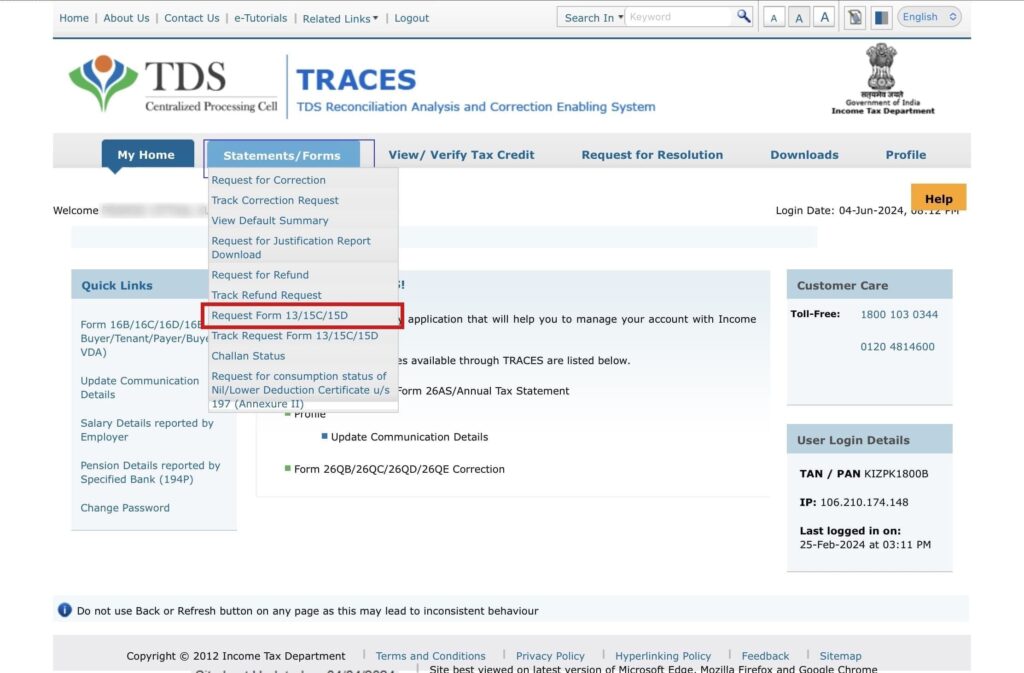

3. Select Request Form 13

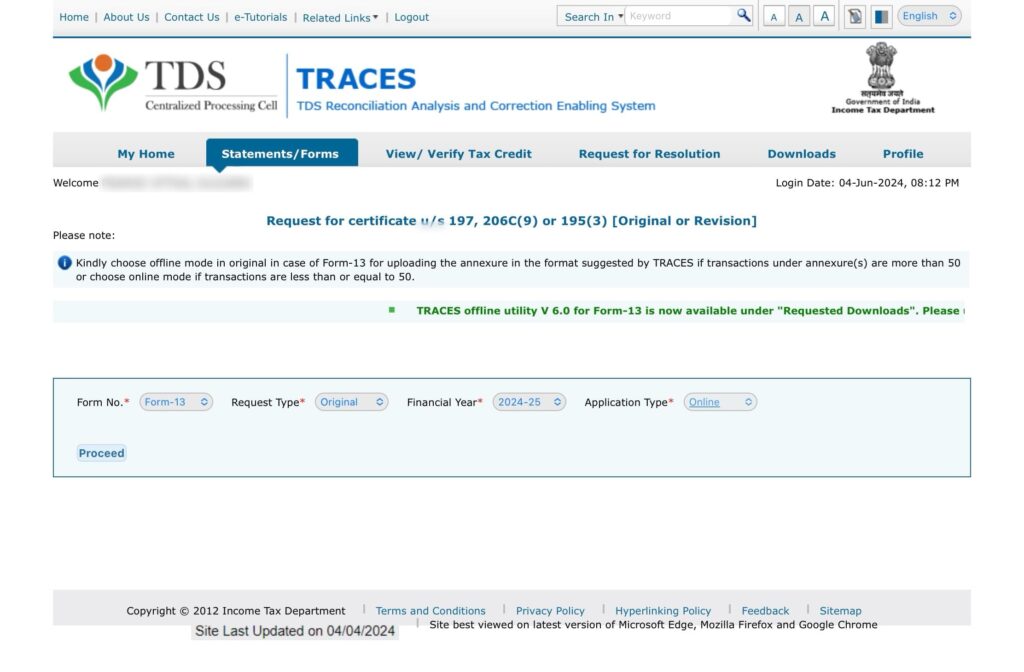

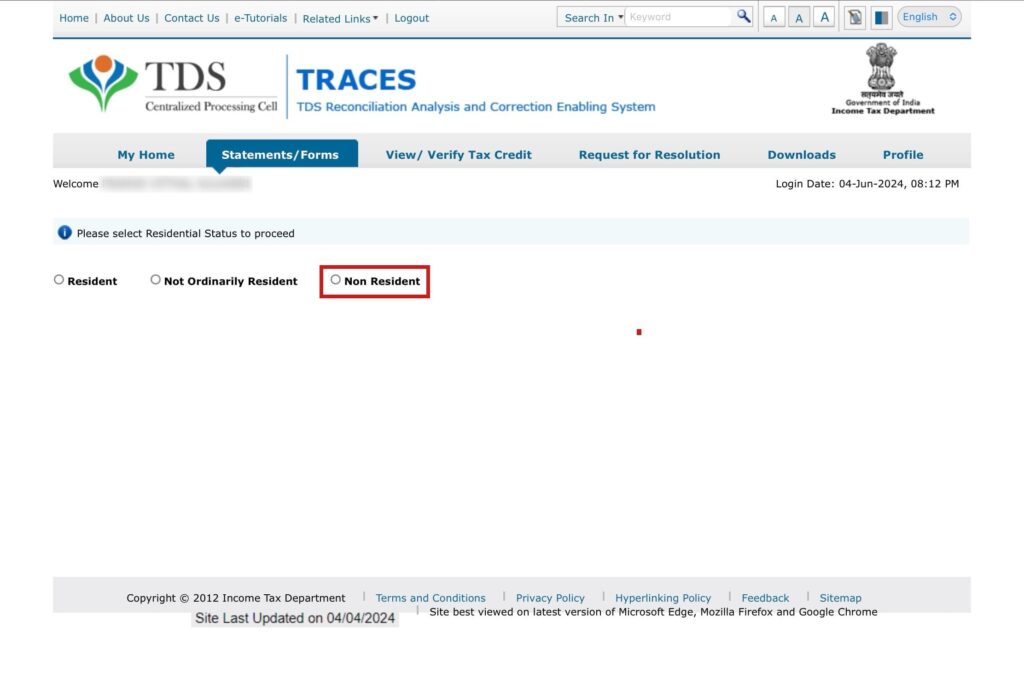

4. Select Non-resident

5. Select relevant options from the drop down list

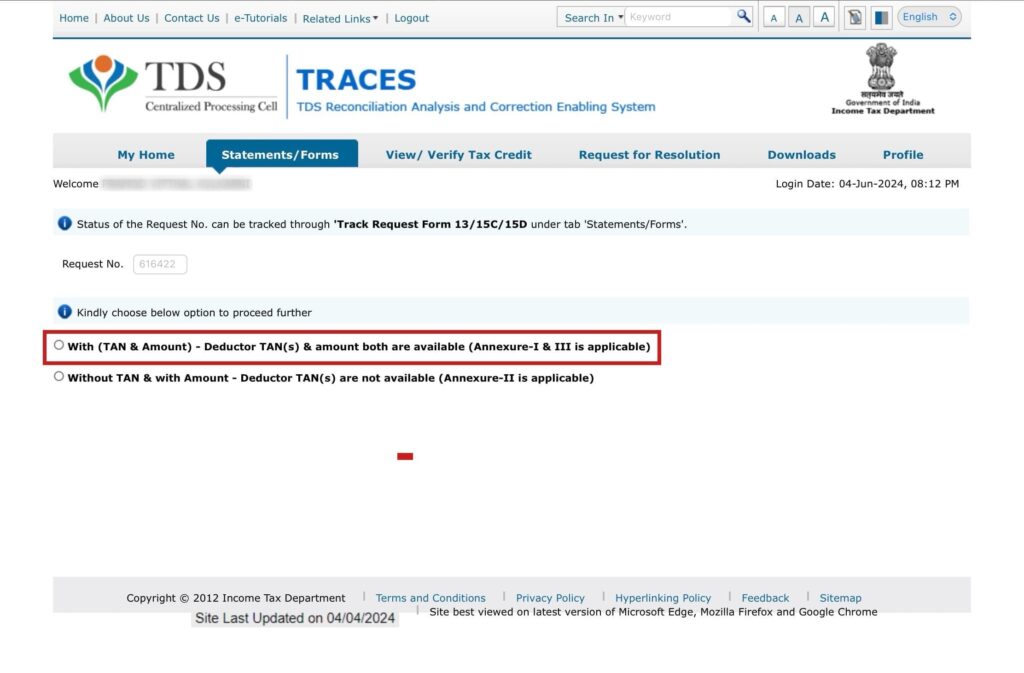

6. Select With (TAN & Amount)

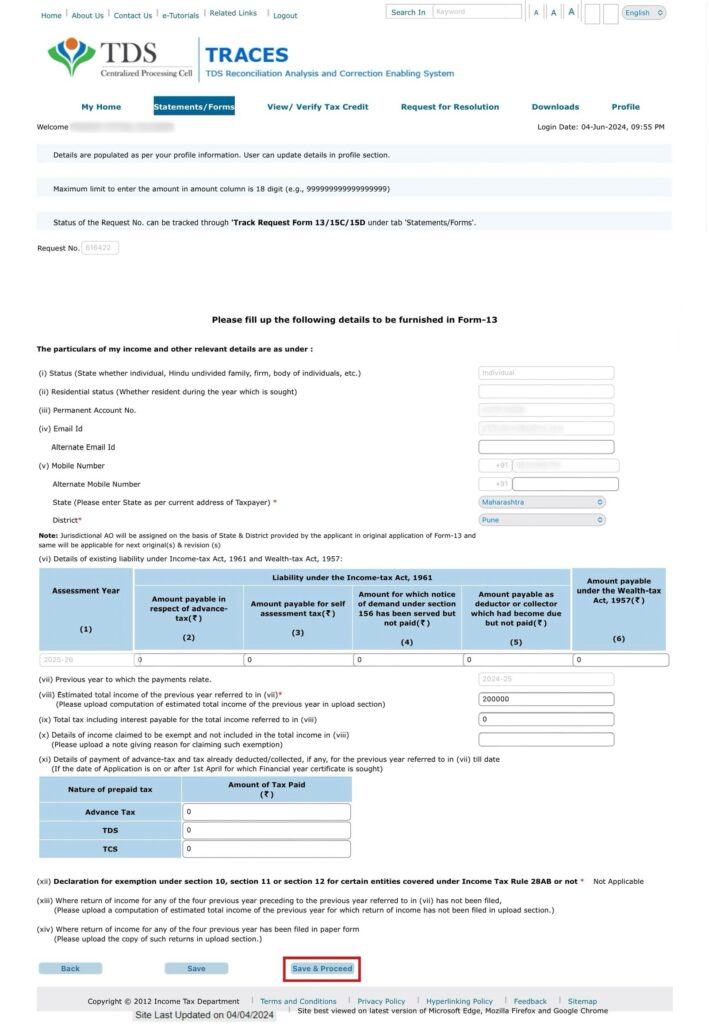

7. Fill appropriate details then click on Save & Proceed

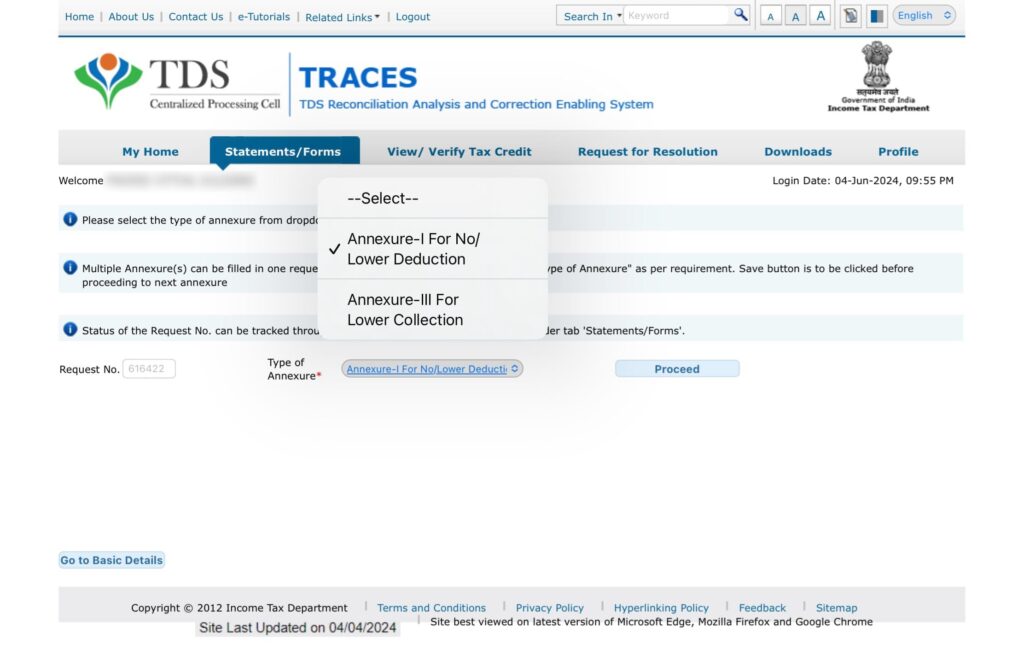

8. Select Annexure I from the drop down

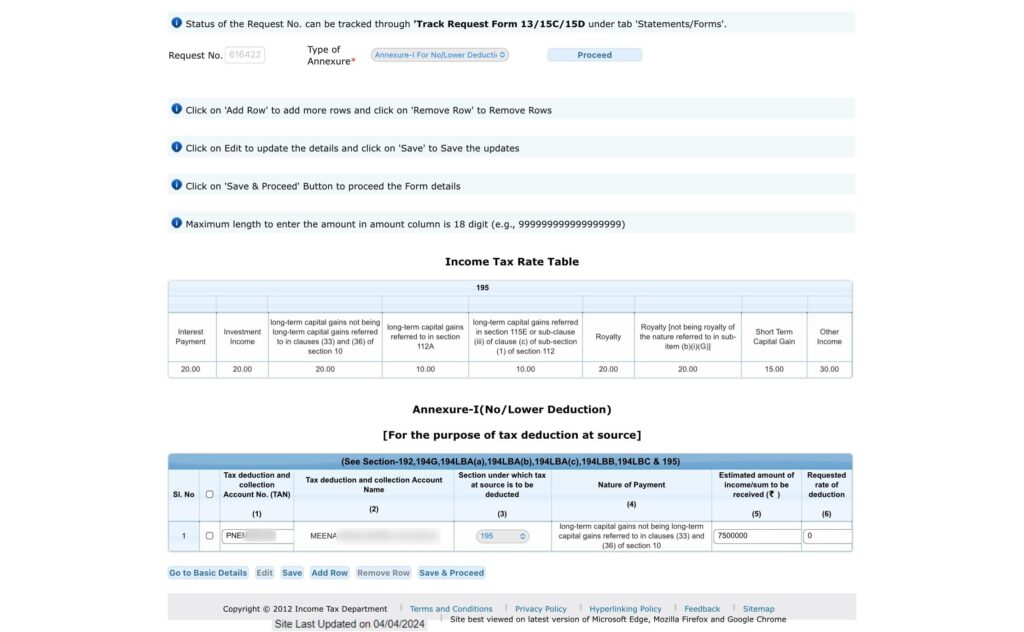

9. Fill buyer’s TAN an other details as shown below

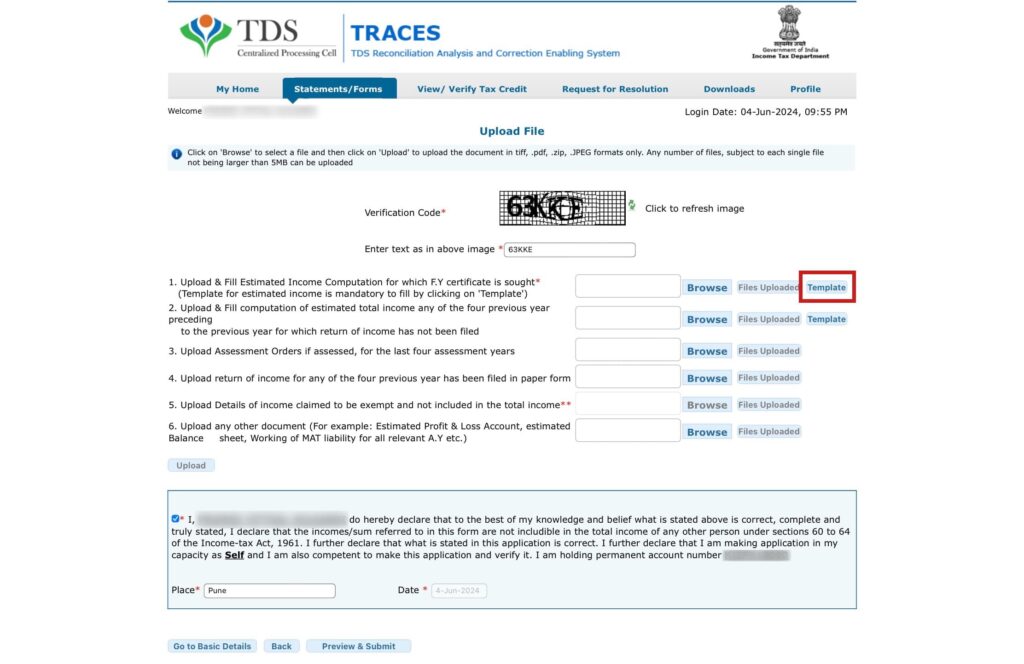

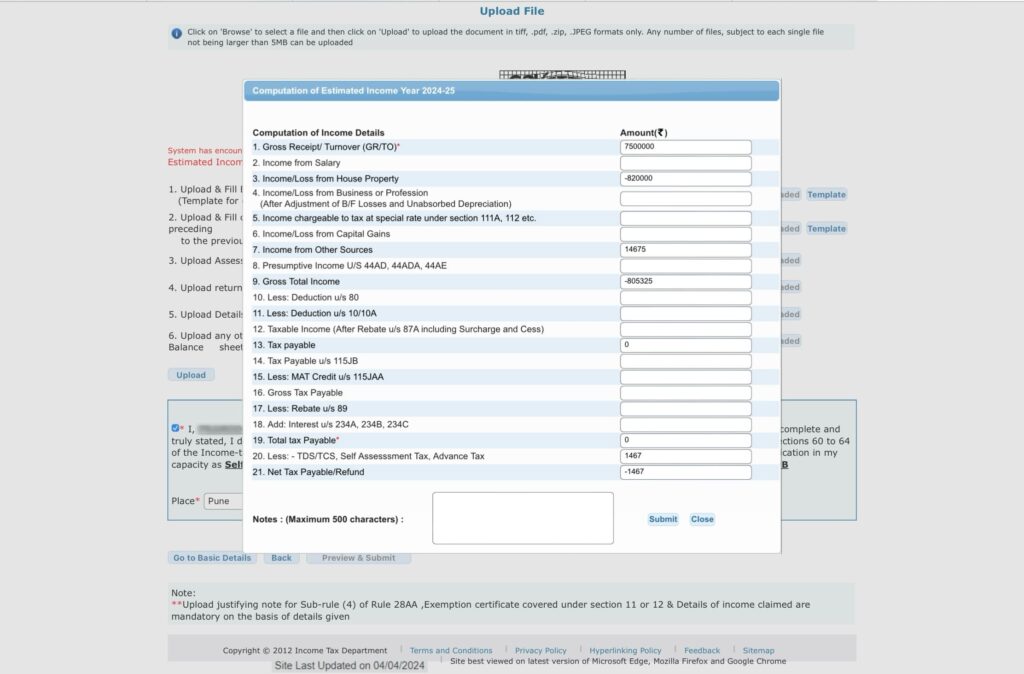

10. Upload all applicable attachments the click on template button

11. Fill you Computation of Income/Loss in the pop up

12. Preview and submit the application

13. Attend before the jurisdictional ITO with physical copy of documents

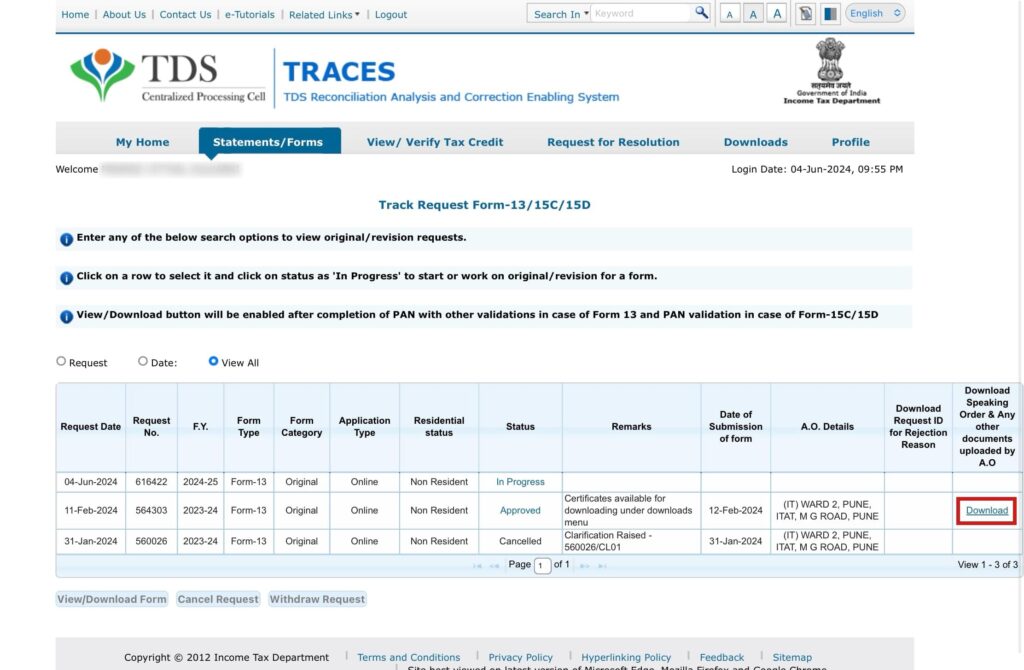

14. Once application is approved by ITO, order can be downloaded from under Track Request Form 13

Steps to be taken after getting Lower/Nil TDS deduction certificate

Quote the unique number of the certificate in the sale deed

Buyer needs to file Form 27Q within 1 month from the end of the quarter in which transaction takes place

Seller should obtain copy of Form 16A from buyer within 15 days of filing of TDS return

Seller needs to make investment prescribed under any of the modes under Section 54 (not applicable in case of capital loss)

Seller to file his/her Income tax return by 31st July of next financial year

Frequently asked questions

Q. Is it mandatory for buyer to obtain TAN?

A. Yes. TAN is mandatory for all Section 195 cases.

Q. How long does it take to get TAN registration.

A. Average time is 15 days.

Q. How long does it take for certificate to be granted?

A. Once the application in Form 13 is submitted online, it takes about 2 days for it to reflect on the dashboard of the Income tax officer (ITO). After that, applicant has to submit the physical copy of the documents listed above along with covering letter to the Income tax office as there are limited options to submit the documents online. If there are any deficiencies in the application or the documents, the ITO raises a request for clarification on the portal, which must be complied within the stipulated time. The power to issue the certificate is with the ITO of International tax jurisdiction. However, they must take the approval of the Commissioner or Additional Commissioner before the certificate is issued. As per guidelines, it is mandatory for ITO to dispose the request within 30 days from end of the month in which application is made. For eg, an application made on 12th July needs to be decided upon by ITO before 3oth August. However average time is 3 weeks from date of submission of online application.

Q. What is the validity of the certificate?

A. Certificate is granted for a particular financial year. If transaction is not executed in that financial year, then fresh certificate needs to be obtained, if transaction spills over into next financial year.

Q. Original buyer backed out of the transaction after getting the certificate. Now I have found a new buyer. Can I use the same certificate for this transaction?

A. No. Certificate is issued for specific buyer against his/her TAN only. If buyer has changed, fresh certificate needs to be obtained.

Q. I have read that TDS rate is 1% for sale of immovable property and that too if value exceeds Rs. 50 lakhs. Then why is 20% TDS applicable in my case?

A. The TDS rate of 1% is only applicable to resident sellers. In these cases the buyer will fill Form 26QB and need not even apply for TAN. But in Section 195 cases base tax rate is 20%. Also threshold exemption limit of Rs. 50 lakhs is not applicable. That means TDS is applicable from Rupee 1.

Q. What if I show that I am a resident and ask buyer to deduct 1% TDS instead of 20%?

A. Seller may face prosecution for misrepresenting his residential status to the Income tax department. Primary responsibility to deduct TDS is that of the buyer and he/she may be saddled with differential tax burden of 19% plus interest and up to 100% penalty. Also sub-registrar office may raise objection while the sale deed is being registered.

What are the relevant statutory provisions

Section 197 – Certificate for deduction at lower rate

(1) Subject to rules made under sub-section (2A), where, in the case of any income of any person [or sum payable to any person], income-tax is required to be deducted at the time of credit or, as the case may be, at the time of payment at the rates in force under the provisions of sections 192, 193, 194, 194A, 194C, 194D, 194G, 194H, 194-I, 194J, 194K, 194LA,194LBA, 194LBB, 194LBC, 194M, 194-O and 195, the Assessing Officer is satisfied that the total income of the recipient justifies the deduction of income-tax at any lower rates or no deduction of income-tax, as the case may be, the Assessing Officer shall, on an application made by the assessee in this behalf, give to him such certificate as may be appropriate. (2) Where any such certificate is given, the person responsible for paying the income shall, until such certificate is cancelled by the Assessing Officer, deduct income-tax at the rates specified in such certificate or deduct no tax, as the case may be. (2A) The Board may, having regard to the convenience of assessees and the interests of revenue, by notification in the Official Gazette, make rules specifying the cases in which, and the circumstances under which, an application may be made for the grant of a certificate under sub-section (1) and the conditions subject to which such certificate may be granted and providing for all other matters connected therewith.

Rule 28 – Application for grant of certificates for deduction of income-tax at any lower rates or no deduction of income-tax

(1) An application by a person for grant of a certificate for the deduction of income-tax at any lower rates or no deduction of income-tax, as the case may be, under sub-section (1) of section 197 shall be made in Form No. 13 electronically, —

| (i) | under digital signature; or |

| (ii) | through electronic verification code. |

(2) The Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems), as the case may be, shall lay down procedures, formats and standards for ensuring secure capture and transmission of data and uploading of documents and the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems) shall also be responsible for evolving and implementing appropriate security, archival and retrieval policies in relation to the furnishing of Form No.13.

Rule 28AA – Certificate for deduction at lower rates or no deduction of tax from income other than dividends

(1) Where the Assessing Officer, on an application made by a person under sub-rule (1) of rule 28 is satisfied that existing and estimated tax liability of a person justifies the deduction of tax at lower rate or no deduction of tax, as the case may be, the Assessing Officer shall issue a certificate in accordance with the provisions of sub-section (1) of section 197 for deduction of tax at such lower rate or no deduction of tax.

(2) The existing and estimated liability referred to in sub-rule (1) shall be determined by the Assessing Officer after taking into consideration the following:—

| (i) | tax payable on estimated income of the previous year relevant to the assessment year; |

| (ii) | tax payable on the assessed or returned or estimated income, as the case may be, of last four previous years; |

| (iii) | existing liability under the Income-tax Act, 1961 and Wealth-tax Act, 1957; |

| (iv) | advance tax payment, tax deducted at source and tax collected at source for the assessment year relevant to the previous year till the date of making application under sub-rule (1) of rule 28; |

(3) The certificate shall be valid for such period of the previous year as may be specified in the certificate, unless it is cancelled by the Assessing Officer at any time before the expiry of the specified period.

(4) The certificate for deduction of tax at any lower rates or no deduction of tax, as the case may be, shall be issued direct to the person responsible for deducting the tax under advice to the person who made an application for issue of such certificate:

Provided that where the number of persons responsible for deducting the tax is likely to exceed one hundred and the details of such persons are not available at the time of making application with the person making such application, the certificate for deduction of tax at lower rate may be issued to the person who made an application for issue of such certificate, authorising him to receive income or sum after deduction of tax at lower rate.

(5) The certificates referred to in sub-rule (4) shall be valid only with regard to the person responsible for deducting the tax and named therein and certificate referred to in proviso to the sub-rule (4) shall be valid with regard to the person who made an application for issue of such certificate.

(6) The Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems), as the case may be, shall lay down procedures, formats and standards for issuance of certificates under sub-rule (4) and proviso thereto and the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems) shall also be responsible for evolving and implementing appropriate security, archival and retrieval policies in relation to the issuance of said certificate.

Notification No. 02/2023 dated 27th September, 2023 – Procedure, format and standards for filling an application